Cryptocurrencies have gained significant attention in recent years, and among the many options available, Litecoin stands out as a unique and promising digital asset. In this guide, we will explore the special features that make Litecoin an attractive investment and a popular choice among cryptocurrency enthusiasts.

What is LTC?

Litecoin is a peer-to-peer cryptocurrency that was created by Charlie Lee, a former Google engineer, in 2011. It is often considered the silver to Bitcoin’s gold and shares many similarities with Bitcoin in terms of its technical implementation. However, Litecoin also offers several distinct advantages that set it apart from other cryptocurrencies.

Why is LTC So Special?

1. Faster Transaction Speeds

One of the key features that make LTC special is its faster block generation time. While Bitcoin has a 10-minute block generation time, Litecoin’s block time is just 2.5 minutes. This means that transactions can be confirmed more quickly, making Litecoin a preferred choice for those who value speed and efficiency in their transactions.

2. Higher Coin Limit

LTC also differs from Bitcoin in terms of its maximum coin supply. Bitcoin has a capped supply of 21 million coins, while Litecoin has a maximum supply of 84 million coins. This higher limit allows for more widespread distribution and can potentially reduce the risk of deflation, making Litecoin an appealing option for long-term investment.

3. Active Development Community

Another factor that contributes to Litecoin’s appeal is its active development community. The cryptocurrency has a dedicated team of developers who are continuously working to improve its technology and implement new features. This ongoing development ensures that Litecoin remains relevant and competitive in the ever-evolving cryptocurrency market.

How Many LTC Coins Are There?

As mentioned earlier, the maximum supply of LTC is capped at 84 million coins. This predetermined limit sets Litecoin apart from traditional fiat currencies, which are subject to inflationary measures. The scarcity of Litecoin’s supply is a key factor that influences its value and makes it an attractive digital asset for investors.

What is the All-Time High for LTC?

The all-time high (ATH) for Litecoin occurred in December 2017, when its price surged to over $360 per coin. This significant milestone demonstrated the potential for substantial growth and investment returns within the cryptocurrency market. While the market is inherently volatile, the ATH serves as a testament to the value and potential of Litecoin as a digital asset.

How does it differ from bitcoin?

LTC is a cryptocurrency that was created in 2011 by Charlie Lee, a former Google engineer. It is often referred to as the silver to Bitcoin’s gold and shares many similarities with Bitcoin, but there are several key differences that set it apart.

Differences from Bitcoin

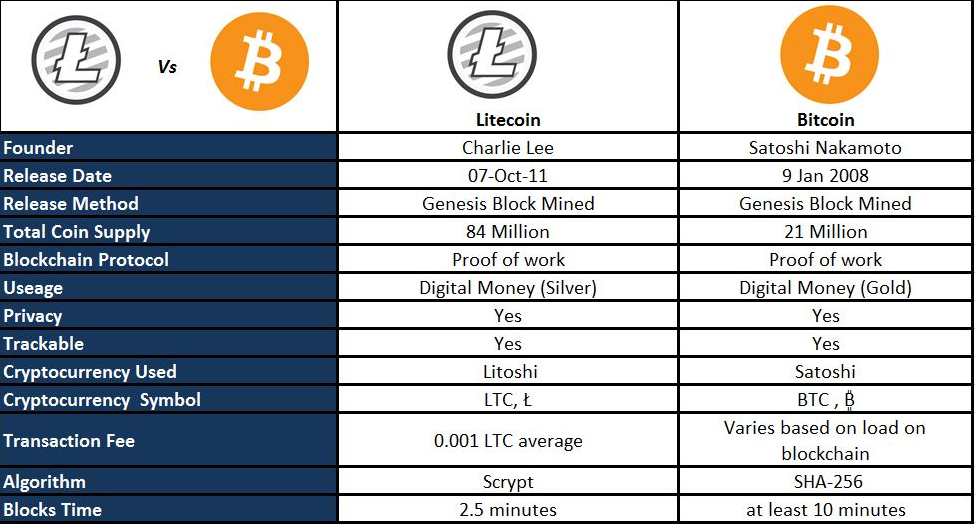

- Consensus Mechanism: LTC is a hard fork of Bitcoin that uses a different consensus mechanism. While both are designed as payment methods, Litecoin has a faster block generation time, with a block time of 2.5 minutes compared to Bitcoin’s 10 minutes.

- Cryptographic Algorithms: LTC and Bitcoin use different cryptographic algorithms. Bitcoin uses the SHA-256 algorithm, while LTC uses the Scrypt algorithm. This difference affects the mining process and the speed of transaction processing.

- Market Capitalization and Coin Supply: Bitcoin has a larger market capitalization and a maximum supply of 21 million coins, while Litecoin can have up to 84 million coins. This higher coin limit allows for more widespread distribution and can potentially reduce the risk of deflation.

In summary, Litecoin differs from Bitcoin in its consensus mechanism, cryptographic algorithms, transaction speed, market capitalization, and coin supply. These differences contribute to Litecoin’s unique position in the cryptocurrency market and its appeal to investors and users.

What are the advantages and disadvantages of using LTC over bitcoin?

Litecoin and Bitcoin are two of the most popular cryptocurrencies in the market. While they share some similarities, there are also several advantages and disadvantages of using Litecoin over Bitcoin.

Advantages of Using LTC Over Bitcoin

- Faster Transaction Speeds: LTC has a faster block generation time of 2.5 minutes compared to Bitcoin’s 10 minutes. This means that transactions can be confirmed more quickly, making Litecoin a preferred choice for those who value speed and efficiency in their transactions.

- Lower Transaction Fees: Litecoin’s transaction fees are generally lower than Bitcoin’s. At the time of writing, Bitcoin transaction fees were around 3.92% on average, compared to Litecoin’s transaction fees of roughly 0.06%.

- Higher Coin Limit: LTC has a maximum supply of 84 million coins, while Bitcoin has a maximum supply of 21 million coins. This higher coin limit allows for more widespread distribution and can potentially reduce the risk of deflation.

- Active Development Community: LTC has a dedicated team of developers who are continuously working to improve its technology and implement new features. This ongoing development ensures that Litecoin remains relevant and competitive in the ever-evolving cryptocurrency market.

Disadvantages of Using LTC Over Bitcoin

- Lower Market Capitalization: Bitcoin has a larger market capitalization compared to LTC. This means that Bitcoin is more widely accepted and has a larger user base.

- Less Secure: Litecoin’s faster transaction speed comes at the expense of security. Litecoin’s confirmation time of 2.5 minutes is faster than Bitcoin’s roughly 10 minutes, but it also means that there are fewer rounds of confirmation, which can potentially make it less secure.

- Less Established: While LTC has been around since 2011, it is still less established than Bitcoin and has yet to achieve the same level of adoption and recognition.

In summary, Litecoin offers several advantages over Bitcoin, such as faster transaction speeds, lower transaction fees, higher coin limit, and an active development community. However, it also has some disadvantages, such as lower market capitalization, less security, and less established status. Ultimately, the choice between Litecoin and Bitcoin depends on an individual’s specific needs and preferences.

How does the mining process for LTC differ from bitcoin?

The mining process for LTC differs from Bitcoin in several ways, primarily due to the different cryptographic algorithms used by each cryptocurrency.

Litecoin Mining Process

- Scrypt Algorithm: LTC uses a modified version of the Scrypt algorithm, which is considered more memory-intensive than Bitcoin’s SHA-256 algorithm. This makes Litecoin mining more accessible to individual miners using consumer-grade hardware.

- Faster Block Generation Time: LTC has a faster block generation time of 2.5 minutes, compared to Bitcoin’s 10 minutes. This allows for more transactions to be processed per unit of time compared to Bitcoin.

- Higher Coin Limit: LTC has a maximum supply of 84 million coins, while Bitcoin has a maximum supply of 21 million coins.

Bitcoin Mining Process

- SHA-256 Algorithm: Bitcoin uses the SHA-256 algorithm, which is less memory-intensive than Scrypt. This has led to the development of specialized hardware, such as ASICs, for Bitcoin mining.

- Slower Block Generation Time: Bitcoin has a slower block generation time of approximately 10 minutes, compared to Litecoin’s 2.5 minutes.

- Lower Coin Limit: Bitcoin has a maximum supply of 21 million coins, which is lower than Litecoin’s maximum supply of 84 million coins.

In summary, the mining process for LTC differs from Bitcoin in terms of the cryptographic algorithms used, block generation time, coin limit, and accessibility to individual miners. These differences contribute to the unique position of Litecoin in the cryptocurrency market and its appeal to miners and investors.

What is the current hash rate for LTC and how does it compare to bitcoin?

The current hash rate for LTC is approximately 950.98 TH/s. In comparison, the hash rate for Bitcoin is significantly higher, with the Bitcoin network hashed at 477,282 Eh/s, which is more than 1 million times that of Litecoin. This demonstrates that the Bitcoin network has a much higher computational power dedicated to securing and maintaining its blockchain compared to the LTC network.

How can i buy LTC and what are the risks involved?

To buy LTC, you can use a reliable and regulated cryptocurrency exchange or trading platform. Some popular methods for purchasing Litecoin include “buy and hold” strategies and spot trading. It is essential to choose a secure service when buying Litecoin to mitigate potential risks. For example, the wirexapp.com service offers reliable protection mechanisms for purchasing and trading Litecoin.

When considering the risks involved in buying LTC, it’s important to be aware of the price volatility associated with cryptocurrencies. Litecoin, like other cryptocurrencies, is subject to significant price fluctuations, and investing in it can be risky. Additionally, the cryptocurrency market is extraordinarily volatile, and Litecoin’s value can change dramatically.

It’s crucial to make investment decisions based on your own financial goals, conduct thorough market research, and consider the potential risks and rewards associated with Litecoin investments. Some of the risks involved in investing in Litecoin include its price volatility, the potential for significant price fluctuations, and the fact that it could eventually become worthless.

Furthermore, Litecoin’s availability as a form of payment is limited, and it lacks a clear use case, which can impact its long-term value. Additionally, government regulations and media attention can influence the value of Litecoin. It’s important to carefully assess these risks and consider them when making investment decisions.

In summary, buying Litecoin involves the potential for price volatility and market risks. It’s essential to approach Litecoin investments with caution, conduct thorough research, and consider the factors that can impact its value and long-term viability.

What are the steps to buy LTC?

To buy LTC, you can follow these general steps, which may vary slightly depending on the platform or service you choose:

- Choose a Cryptocurrency Exchange: Select a reputable and regulated cryptocurrency exchange or trading platform, such as Coinbase, Binance, or Kraken.

- Create an Account: Register and create an account on the chosen exchange or platform. This typically involves providing your personal information and verifying your identity.

- Add a Payment Method: Link a payment method to your account, such as a bank account, credit card, or debit card. This will allow you to fund your account for the purchase of Litecoin.

- Search and Select Litecoin: Once your account is set up and funded, search for Litecoin on the exchange or platform. Select LTC as the cryptocurrency you want to buy.

- Enter the Amount to Buy: Input the amount of fiat currency you want to spend on Litecoin. The platform will automatically convert this amount into the equivalent value of Litecoin.

- Finalize the Purchase: Review the details of your purchase, ensure everything looks accurate, and then confirm the purchase. This may involve clicking a “Buy” or “Confirm” button, depending on the platform.

- Store Your Litecoin: After the purchase is complete, you will have the option to store your Litecoin in a wallet provided by the exchange or transfer it to a private wallet for added security.

It’s important to consider the risks involved in buying LTC, such as price volatility, market risk, and the potential for significant price fluctuations. Additionally, choosing a secure and regulated platform is crucial to mitigate potential unforeseen difficulties when buying and holding LTC. Always conduct thorough research and consider the factors that can impact the value and long-term viability of Litecoin before making any investment decisions.

What is the minimum amount of LTC that can be purchased?

The minimum amount of Litecoin that can be purchased varies depending on the exchange or platform used. Some exchanges, such as ChangeNOW, allow users to purchase at least $2 worth of LTC.

Other exchanges, such as Kraken, allow users to buy Litecoin with as little as $105. It’s important to note that the minimum amount may also depend on the payment method used and the exchange’s policies. It’s recommended to check the specific exchange or platform’s minimum purchase amount before making a transaction.

Will LTC reach $10,000 ?

Based on the available search results, there is no clear evidence that LTC will reach $10,000. While some sources predict that Litecoin’s price could rise significantly in the future, with some predicting a possible high of $5,000 or even $6,000 by 2030, there is no indication that it will reach $10,000.

It’s important to note that cryptocurrency prices are highly volatile and subject to significant fluctuations, and any predictions should be taken with caution. It’s essential to conduct thorough research and consider the potential risks and rewards associated with LTC investments before making any investment decisions.

What are some potential benefits that could help litecoin reach $10,000?

While it is difficult to predict with certainty whether LTC will reach $10,000, there are several potential benefits that could contribute to its growth:

- Faster Transaction Speeds: Litecoin’s block generation time is about 2.5 minutes, which is significantly faster than Bitcoin’s 10 minutes. This faster transaction speed could make Litecoin more appealing to users and merchants, potentially driving demand and increasing its value.

- Lower Transaction Fees: LTC has lower transaction fees compared to Bitcoin, making it a more cost-effective option for users. This could attract more users and increase the adoption of Litecoin, potentially contributing to its growth.

- Increased Adoption: As more businesses and individuals adopt Litecoin as a form of payment or investment, its value could increase due to increased demand.

- Technological Innovations: LTC’s focus on technological advancements and improvements could make it more attractive to investors and users, potentially driving its growth3.

- Partnerships and Collaborations: LTC’s collaborations with various companies and projects could contribute to its growth by increasing its visibility and adoption.

- Market Capitalization: LTC’s market capitalization is currently lower than Bitcoin’s, which could provide room for growth if its value increases.

However, it’s essential to note that these factors are not guaranteed to push LTC’s price to $10,000. Cryptocurrency prices are highly volatile and subject to significant fluctuations, and any predictions should be taken with caution. It’s crucial to conduct thorough research and consider the potential risks and rewards associated with Litecoin investments before making any investment decisions.

LTC price prediction 2030

Based on the available search results, LTC price predictions for 2030 vary widely. Some sources predict that LTC’s price could rise significantly in the future, with some predicting a possible high of $5,000 or even $6,000 by 2030.

However, there is no clear evidence that Litecoin will reach $10,000. It’s important to note that cryptocurrency prices are highly volatile and subject to significant fluctuations, and any predictions should be taken with caution. It’s crucial to conduct thorough research and consider the potential risks and rewards associated with Litecoin investments before making any investment decisions.

What are some of the potential risks that could prevent LTC from reaching $5000 by 2030?

There are several potential risks that could prevent Litecoin from reaching $5,000 by 2030, including:

- Competition from Other Cryptocurrencies: LTC faces competition from other cryptocurrencies that offer similar features, such as faster transaction speeds and lower fees. This competition could limit Litecoin’s growth potential and impact its value.

- Regulatory Changes: Changes in government regulations or policies could impact the adoption and use of LTC, potentially limiting its growth potential.

- Market Volatility: The cryptocurrency market is highly volatile, and LTC’s value could be impacted by sudden market fluctuations or changes in investor sentiment.

- Lack of Adoption: If LTC fails to gain widespread adoption as a form of payment or investment, its growth potential could be limited.

- Technological Advances: Technological advancements in the cryptocurrency industry could make LTC’s features less attractive or obsolete, potentially limiting its growth potential.

It’s important to note that these risks are not exhaustive and that there may be other factors that could impact LTC’s growth potential. It’s crucial to conduct thorough research and consider the potential risks and rewards associated with LTC investments before making any investment decisions.

Based on the available search results, investing in LTC can be a good option for those who are willing to take on the risks associated with cryptocurrency investments. Litecoin has several advantages, such as faster transaction speeds, lower transaction fees, and an active development community, which make it an attractive investment option.

However, it’s important to note that cryptocurrency prices are highly volatile and subject to significant fluctuations, and any predictions should be taken with caution. Additionally, there are potential risks associated with investing in Litecoin, such as competition from other cryptocurrencies, regulatory changes, market volatility, lack of adoption, and technological advances.

Therefore, it’s crucial to conduct thorough research, consider the potential risks and rewards, and make investment decisions based on individual financial goals and risk tolerance.

1 thought on “Why is Litecoin so special in 2024?”