Amp Crypto Price Prediction: How High Can It Go by 2030?

Amp is a digital token that aims to provide instant, verifiable collateral for any kind of value transfer. It is designed to enhance the security and efficiency of transactions across various platforms and networks. Amp claims to be the first asset token that can collateralize any form of value transfer, whether it is digital or physical, fiat or crypto, or even a service or a resource.

In this blog post, we will explore what Amp is, how it works, and what are its advantages and challenges. We will also look at some of the factors that may influence its price in the future, and provide some possible scenarios for its price prediction in 2025 and 2030.

What is Amp and How Does It Work?

Amp is an Ethereum-based token that acts as a collateral layer for various payment networks and applications. It allows users to stake Amp tokens to guarantee the completion of a transaction, regardless of the underlying asset or platform. For example, if a user wants to pay with a credit card on a decentralized exchange, they can use Amp to secure the payment until it is confirmed by the card issuer. If the payment fails, the Amp tokens are liquidated to cover the loss, and if the payment succeeds, the Amp tokens are released back to the user.

Amp is based on the concept of partition strategies, which are smart contracts that define the terms and conditions of the collateralization. Partition strategies can be customized to suit different use cases, such as e-commerce, DeFi, or remittance. Amp also supports interoperability, meaning that it can work with any platform or network that can integrate with its open-source interface.

What are the benefits of Amp?

Amp offers several benefits for both users and developers who want to enable fast and secure value transfers. Some of the benefits are:

- Reduced risk and cost: Amp reduces the risk and cost of value transfers by providing a reliable and transparent way of collateralizing them. Amp eliminates the need for intermediaries, chargebacks, or fraud prevention measures, which can add friction and fees to the payment process. Amp also lowers the volatility and liquidity risks of crypto payments, as the Amp tokens are only locked for a short period of time and can be easily exchanged for other assets.

- Increased speed and efficiency: Amp increases the speed and efficiency of value transfers by enabling instant and verifiable assurances. Amp allows users to complete transactions without waiting for confirmations or settlements, which can take minutes or hours depending on the network. Amp also improves the scalability and throughput of value transfers, as it can support multiple transactions with the same collateral.

- Enhanced flexibility and interoperability: Amp enhances the flexibility and interoperability of value transfers by providing a standardized and adaptable collateralization framework. Amp can support any form of value transfer, such as fiat, crypto, or physical assets, and can be integrated with any network or platform, such as Ethereum, Bitcoin, or Shopify. Amp can also support multiple consensus mechanisms and collateral managers, which can be customized to fit different use cases and scenarios.

What are the challenges of Amp?

Amp also faces some challenges and limitations that may affect its adoption and performance. Some of the challenges are:

- Regulatory uncertainty: Amp operates in a highly regulated and evolving industry, which may pose legal and compliance risks. Amp may be subject to different rules and regulations in different jurisdictions, which may limit its availability and functionality. Amp may also face competition or conflict from existing or emerging payment systems, such as central bank digital currencies (CBDCs) or stablecoins, which may have more regulatory support or recognition.

- Technical complexity: Amp relies on a complex and innovative technology, which may entail technical and operational risks. Amp may encounter bugs, errors, or vulnerabilities in its smart contracts, collateral managers, or integrations, which may compromise its security or functionality. Amp may also face scalability or compatibility issues, as it depends on the performance and development of other networks and platforms, such as Ethereum or Flexa.

- Market competition: Amp competes with other projects and solutions that aim to facilitate or improve value transfers, such as payment networks, cryptocurrencies, or DeFi protocols. Amp may struggle to gain or maintain market share, user base, or network effects, especially if its competitors offer better or cheaper services or products. Amp may also face challenges in differentiating itself or creating a unique value proposition, as its features or benefits may be replicated or surpassed by other projects.

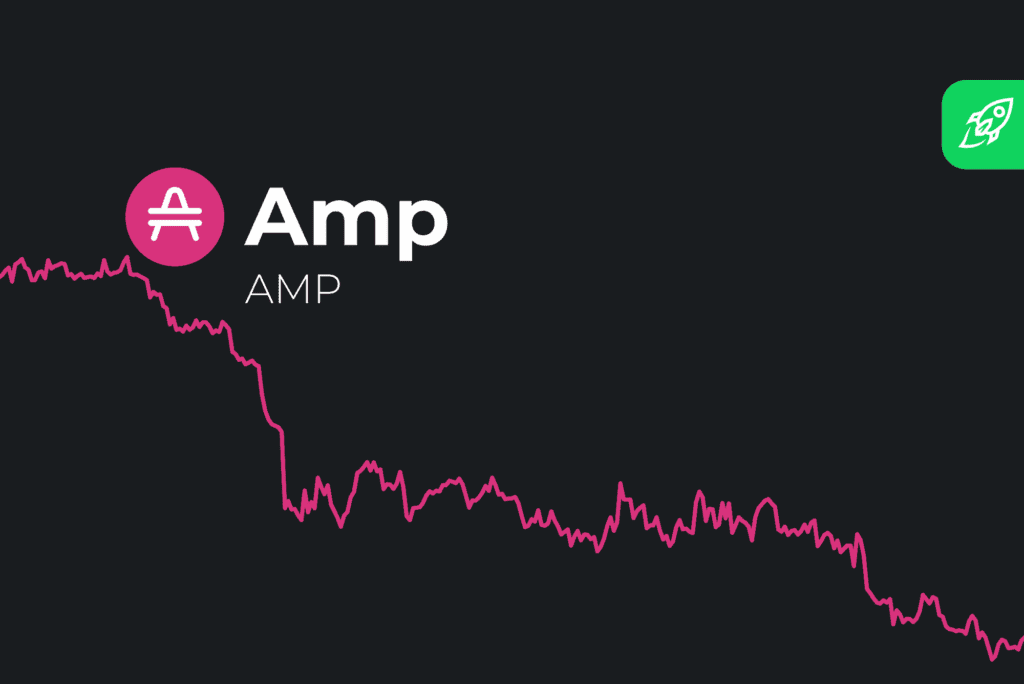

Amp Crypto Price History

Amp was launched in September 2020, as a rebranding and extension of Flexa Network’s Flexacoin, which was introduced in 2019. Flexa Network is a payment protocol that allows users to spend cryptocurrencies at various merchants, such as Starbucks, Nordstrom, or GameStop. Flexa uses Amp as its native collateral token, to secure the transactions and ensure instant settlement.

According to CoinMarketCap, Amp’s initial price was $0.0097 on September 2, 2020. It remained relatively stable until January 2021, when it started to increase gradually, reaching $0.0296 on February 12, 2021. It then experienced a sharp spike, reaching an all-time high of $0.1211 on June 16, 2021, following the announcement of its listing on Coinbase Pro, one of the largest and most popular cryptocurrency exchanges in the world. However, it soon corrected, dropping to $0.0488 on July 20, 2021. As of August 31, 2021, Amp’s price was $0.0593, with a market capitalization of $2.48 billion, and a circulating supply of 41.86 billion tokens out of a total supply of 92.55 billion tokens.

Amp Crypto Price Prediction 2025

Predicting the future price of any cryptocurrency is a difficult and uncertain task, as there are many factors that can affect the supply and demand of the market, such as technological innovation, regulatory developments, user adoption, media attention, or market sentiment. Therefore, any price prediction should be taken with a grain of salt, and not as a financial advice.

That being said, here are some possible scenarios for Amp’s price prediction in 2025, based on different assumptions and projections.

Scenario: Bullish

In this scenario, we assume that Amp will continue to grow and expand its use cases and partnerships, becoming one of the leading collateral tokens in the crypto space. We also assume that the overall crypto market will remain in a bullish trend, driven by the increasing adoption and innovation of cryptocurrencies and blockchain technology.

Using a compound annual growth rate (CAGR) formula, we can estimate the potential price of Amp in 2025, based on its current price and its historical growth rate. According to CoinMarketCap, Amp’s CAGR since its launch is 337.58%. If we apply this rate to its current price of $0.0593, we get a possible price of $10.34 by the end of 2025. This would imply a market capitalization of $433.11 billion, and a growth of 17,353% from the current level.

Amp Crypto Price Prediction 2030

According to CoinPriceForecast, a website that provides cryptocurrency price predictions based on a combination of fundamental and technical analysis, Amp’s price could reach $0.282 by the end of 2030, which would represent a 852% increase from its current price. This prediction is based on the assumption that Amp will achieve a high level of adoption and integration, and that it will become a leading and dominant player in the value transfer industry.

According to Crypto-Rating, another website that provides cryptocurrency price predictions based on a proprietary algorithm and expert opinions, Amp’s price could reach $0.367 by the end of 2030, which would represent a 1141% increase from its current price. This prediction is based on the assumption that Amp will experience a strong and exponential growth, and that it will leverage its unique and innovative features and benefits to attract and retain users and developers.

Conclusion

Amp is a promising and ambitious project that aims to revolutionize the value transfer industry by providing a flexible, secure, and efficient collateralization framework. Amp has several advantages and opportunities, such as reducing the risk and cost of value transfers, increasing the speed and efficiency of value transfers, and enhancing the flexibility and interoperability of value transfers. Amp also faces some challenges and limitations, such as regulatory uncertainty, technical complexity, and market competition.

Amp’s price prediction is a speculative and uncertain endeavor, as it depends on various factors and assumptions, such as market conditions, user adoption, network development, and regulatory environment. However, based on some of the available data and analysis, we can estimate that Amp’s price could range from $0.1148 to $0.367 by the end of 2030, which would represent a 287% to 1141% increase from its current price.

Disclaimer: This blog post is not financial advice and you should do your own research before investing in any cryptocurrency. The information and opinions expressed in this blog post are for educational and entertainment purposes only and do not constitute any endorsement or recommendation. Cryptocurrencies are volatile and risky, and you may lose all or part of your investment. Past performance is not indicative of future results.