Polygon crypto is a platform that aims to provide scalable, secure, and user-friendly solutions for building and connecting Ethereum-compatible blockchain networks. Polygon was formerly known as Matic Network, and it rebranded itself in February 2021 to reflect its expanded vision and scope. Polygon offers a framework that supports various types of blockchain architectures, such as plasma chains, zk-rollups, optimistic rollups, and standalone chains. Polygon claims to offer the best of both worlds: the benefits of Ethereum’s security, interoperability, and ecosystem, and the advantages of sovereign blockchains, such as speed, scalability, and low cost.

In this blog post, we will explore the potential of Polygon as a project and as a cryptocurrency. We will also look at some of the factors that may influence its price in the future, and provide some Polygon crypto price predictions for 2025 and 2030 based on different sources and methods.

What is Polygon (MATIC)?

Polygon is the native token of the Polygon network. It is an ERC-20 token that runs on the Ethereum blockchain. Polygon has multiple use cases, such as:

- Paying for transaction fees on Polygon-powered networks

- Staking to secure the network and earn rewards

- Participating in governance and voting on network upgrades and changes

- Accessing various applications and services built on Polygon

Polygon has a fixed supply of 10 billion tokens, of which about 6.3 billion are currently in circulation. The token distribution is as follows:

- 22% for the foundation

- 16% for the network operations

- 12% for the ecosystem

- 10% for the team

- 10% for the advisors

- 10% for the reserve

- 8% for the public sale

- 2% for the private sale

Why is Polygon important?

Polygon is important because it addresses some of the major challenges that Ethereum faces, such as scalability, congestion, and high gas fees. Ethereum is the most popular and widely used platform for decentralized applications (DApps), smart contracts, and decentralized finance (DeFi). However, as the demand for Ethereum grows, so does the network load and the competition for block space. This results in slow transactions, high costs, and poor user experience.

Polygon aims to solve these problems by providing a flexible and modular framework that allows developers to create and connect custom-made blockchain networks that are compatible with Ethereum. These networks can leverage the security and network effects of Ethereum, while also enjoying the benefits of their own sovereignty, scalability, and adaptability. Polygon also supports interoperability and cross-chain communication, enabling seamless exchange of value and information between different blockchain networks.

Polygon has already attracted a lot of attention and adoption from various projects and platforms in the crypto space. Some of the notable examples are:

- Aave: A leading DeFi lending protocol that has launched on Polygon to offer fast and cheap transactions for its users.

- Decentraland: A virtual reality platform that has integrated with Polygon to enable faster and cheaper transactions for its digital land and assets.

- SushiSwap: A popular decentralized exchange that has deployed on Polygon to offer lower fees and higher rewards for its liquidity providers and traders.

- QuickSwap: A fork of Uniswap that runs on Polygon and offers near-zero fees and instant transactions for swapping tokens.

- OpenSea: A leading marketplace for non-fungible tokens (NFTs) that has partnered with Polygon to enable free and instant transfers of NFTs.

What are the factors that affect Polygon’s price?

Like any other cryptocurrency, Polygon’s price is influenced by a variety of factors, such as:

- Supply and demand: The basic economic principle of supply and demand applies to Polygon as well. The more people want to buy and use Polygon, the higher its price will go. Conversely, the more people want to sell and get rid of Polygon, the lower its price will drop.

- Market sentiment: The overall mood and attitude of the crypto market and the Polygon community can also affect Polygon’s price. Positive news, events, partnerships, and developments can boost Polygon’s popularity and confidence, and drive its price up. Negative news, events, controversies, and challenges can damage Polygon’s reputation and trust, and drive its price down.

- Competition: Polygon faces competition from other scalability solutions and blockchain platforms, both within and outside the Ethereum ecosystem. Some of the competitors are:

- Layer 2 solutions: These are protocols that run on top of Ethereum and aim to improve its scalability and performance by moving some of the computations and transactions off-chain. Some examples are Optimism, Arbitrum, zkSync, and Loopring.

- Sidechains: These are independent blockchain networks that run parallel to Ethereum and have their own consensus mechanisms and security models. They can communicate with Ethereum via bridges or validators. Some examples are xDai, Binance Smart Chain, and Avalanche.

- Interoperability platforms: These are blockchain networks that aim to connect and enable the transfer of value and data between different blockchains. Some examples are Cosmos, Polkadot, and Cardano.

Polygon’s price may be affected by how well it can compete with these alternatives in terms of features, performance, adoption, and innovation.

- Regulation: Polygon’s price may also be impacted by the regulatory environment and the legal status of cryptocurrencies in different jurisdictions. Polygon operates in a decentralized and permissionless manner, which may pose challenges and risks for regulators and authorities. Polygon’s price may rise or fall depending on how favorable or unfavorable the regulations are for the crypto industry and Polygon in particular.

Polygon Crypto Price Prediction 2025

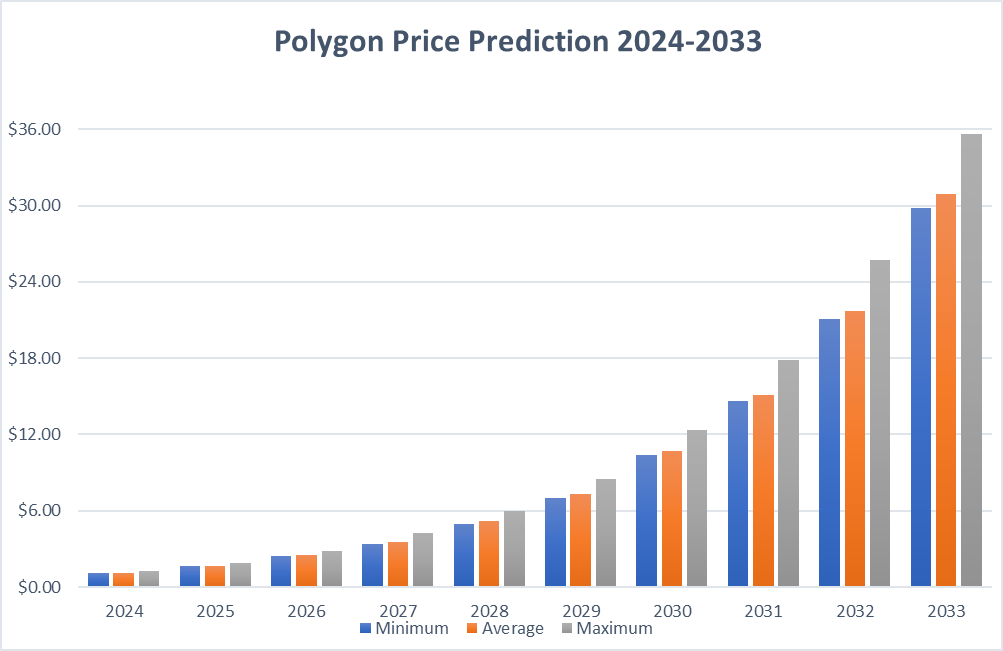

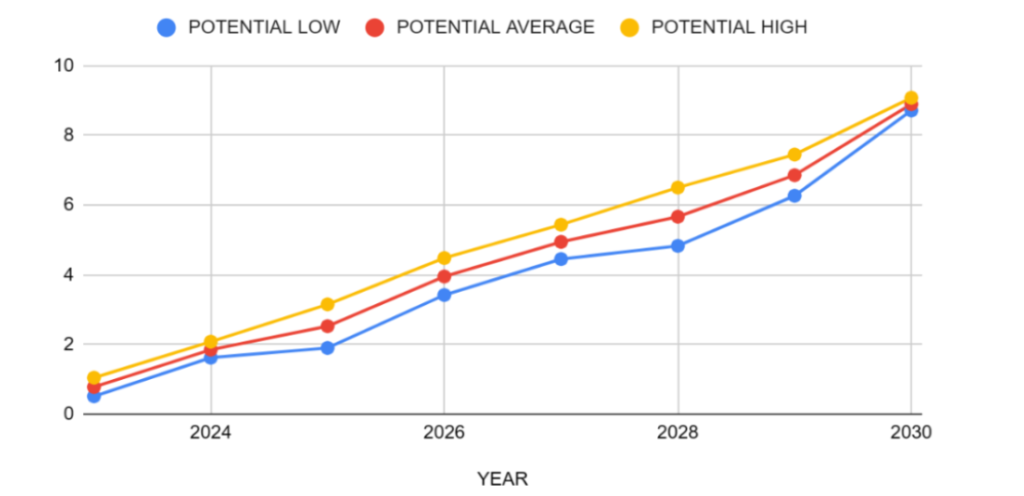

Polygon crypto price prediction for 2025 is based on various sources and methods, such as technical analysis, fundamental analysis, expert opinions, and historical trends. However, it is important to note that these predictions are not financial advice and should not be taken as such. Polygon’s price may change significantly due to unforeseen events and circumstances. Therefore, investors and traders should always do their own research and due diligence before making any investment decisions.

Technical Analysis

Technical analysis is a method of forecasting Polygon’s price based on the analysis of its historical price movements, patterns, trends, and indicators. Technical analysis can use various tools and techniques, such as support and resistance levels, trend lines, moving averages, Fibonacci retracements, and oscillators.

One of the popular technical analysis tools is the Fibonacci retracement, which is based on the Fibonacci sequence, a mathematical pattern that is found in nature and art. The Fibonacci retracement tool can be used to identify potential reversal points and target levels for Polygon’s price, based on its previous highs and lows.

Using the Fibonacci retracement tool, we can draw a line from the all-time high of Polygon ($2.68) to the all-time low ($0.003012) and see the possible retracement levels. The most common Fibonacci retracement levels are 23.6%, 38.2%, 50%, 61.8%, and 78.6%. These levels can act as support or resistance for Polygon’s price, depending on whether it is in an uptrend or a downtrend.

As of February 16, 2024, Polygon’s price is trading at $0.929586, which is slightly above the 23.6% Fibonacci retracement level ($0.9189). This level may act as a support for Polygon’s price, and if it holds, Polygon may resume its uptrend and test the next resistance levels at 38.2% ($1.12), 50% ($1.34), and 61.8% ($1.56). If Polygon breaks above these levels, it may reach the 78.6% level ($1.91), which is close to its previous all-time high.

However, if Polygon’s price fails to stay above the 23.6% level, it may enter a downtrend and test the next support levels at 0% ($0.003012), 14.6% ($0.39), and 19.1% ($0.64). If Polygon breaks below these levels, it may enter a bearish territory and face further downside pressure.

Based on this technical analysis, Polygon’s price prediction for 2025 is between $0.39 and $1.91, with a possible high of $2.68 if it reaches its previous all-time high.

Fundamental Analysis

Fundamental analysis is a method of forecasting Polygon’s price based on the analysis of its underlying value, potential, and prospects. Fundamental analysis can use various factors and metrics, such as:

- Polygon’s vision, mission, and goals

- Polygon’s team, partners, and investors

- Polygon’s technology, innovation, and development

- Polygon’s network activity, adoption, and growth

- Polygon’s tokenomics, supply, and demand

- Polygon’s competition, challenges, and risks

Polygon has a strong and clear vision of providing scalable, secure, and user-friendly solutions for building and connecting Ethereum-compatible blockchain networks. Polygon has a solid team of experienced and talented developers, advisors, and investors, who have backgrounds in blockchain, software, and business. Polygon has a robust and innovative technology stack, which supports various types of blockchain architectures and enables interoperability and cross-chain communication.

Polygon has a high network activity, adoption, and growth, as evidenced by its increasing number of users, transactions, validators, DApps, and partners. Polygon has a sound tokenomics model, which aligns the incentives of the network participants and creates a positive feedback loop for the token value. Polygon faces competition from other scalability solutions and blockchain platforms, but it also has a unique value proposition and a competitive edge in terms of its flexibility, modularity, and compatibility with Ethereum.

How to buy Polygon (MATIC)?

If you are interested in buying Polygon (MATIC), you will need to have an account on a cryptocurrency exchange that supports MATIC trading. Some of the popular exchanges that offer MATIC are:

- Binance: The world’s largest and most liquid cryptocurrency exchange, with over 200 trading pairs and low fees.

- Coinbase: The leading US-based cryptocurrency platform, with a user-friendly interface and a regulated service.

- Kraken: A reputable and secure cryptocurrency exchange, with a wide range of features and options for traders and investors.

- Huobi: A global cryptocurrency exchange, with a strong presence in Asia and a high trading volume.

To buy Polygon (MATIC) on these exchanges, you will need to follow these steps:

- Register and verify your account on the exchange of your choice.

- Deposit some fiat currency (such as USD, EUR, or GBP) or some cryptocurrency (such as BTC or ETH) to your exchange wallet.

- Find the trading pair that matches your deposit currency and MATIC (such as MATIC/USD, MATIC/BTC, or MATIC/ETH) and place a buy order at the current market price or a limit order at your desired price.

- Wait for your order to be filled and receive your MATIC tokens in your exchange wallet.

- Transfer your MATIC tokens to a secure and compatible wallet of your choice, such as MetaMask, [Trust Wallet], or [Polygon Wallet].

What are the advantages and disadvantages of Polygon?

Polygon has many advantages and disadvantages as a platform and as a cryptocurrency. Here are some of the main ones:

Advantages

- Polygon offers a scalable, secure, and user-friendly solution for building and connecting Ethereum-compatible blockchain networks.

- Polygon leverages the security and network effects of Ethereum, while also providing the benefits of sovereign blockchains, such as speed, scalability, and low cost.

- Polygon supports interoperability and cross-chain communication, enabling seamless exchange of value and information between different blockchain networks.

- Polygon has a high network activity, adoption, and growth, as evidenced by its increasing number of users, transactions, validators, DApps, and partners.

- Polygon has a sound tokenomics model, which aligns the incentives of the network participants and creates a positive feedback loop for the token value.

Disadvantages

- Polygon faces competition from other scalability solutions and blockchain platforms, both within and outside the Ethereum ecosystem.

- Polygon relies on Ethereum for its security and interoperability, which may expose it to the risks and challenges of the Ethereum network, such as congestion, high fees, and upgrades.

- Polygon may face regulatory uncertainty and legal issues in different jurisdictions, as it operates in a decentralized and permissionless manner.

- Polygon may experience technical glitches, bugs, or attacks, which may compromise its functionality and performance.

What is the current price of Polygon?

According to the web search results, the current price of Polygon (MATIC) as of February 16, 2024 is:

- $0.929586 USD on CoinMarketCap

- $0.877003 USD on Coinbase

- $0.855209 USD on Binance

- $0.898743 USD on CoinDesk

The price may vary depending on the exchange and the time of the query. Polygon’s price is influenced by various factors, such as supply and demand, market sentiment, competition, and regulation.

How can I stake my MATIC tokens?

Staking MATIC tokens is a way of earning rewards and contributing to the security of the Polygon network. To stake MATIC tokens, you will need to have a compatible wallet, such as MetaMask, Coinbase Wallet, or Polygon Wallet, and connect it to a staking platform or validator. Some of the popular choices are the official Polygon wallet or third-party platforms like Stakefish or Staked. Here are the general steps to stake MATIC tokens:

- Transfer MATIC tokens from the exchange to your wallet.

- Choose a staking platform or validator and connect your wallet.

- Select the amount of MATIC tokens you want to stake and confirm the transaction.

- Wait for the confirmation and start earning rewards.

The rewards and risks may vary depending on the platform or validator you choose, so make sure to do your research and compare the options before staking. You can also use the reward calculator to estimate your potential earnings.

1 thought on “Polygon Crypto Price Prediction in 2024”