If you are looking for the best online brokers and trading platforms to trade cryptocurrencies, you have come to the right place. We have done extensive research on 24 online brokers and trading platforms and ranked them based on various factors that are essential for a great crypto trading experience. These factors include fees, types of crypto assets offered, number of physical coins available to trade, mobile app experience, trade experience, and additional features.

Warning

This review promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd.), UK (eToro UK Ltd.) & USA (by eToro USA LLC); which is highly volatile, unregulated in some EU countries and the UK, no EU or UK consumer protections & not supervised by the EU or UK regulatory framework. Investments are subject to market risk, including the loss of principal.

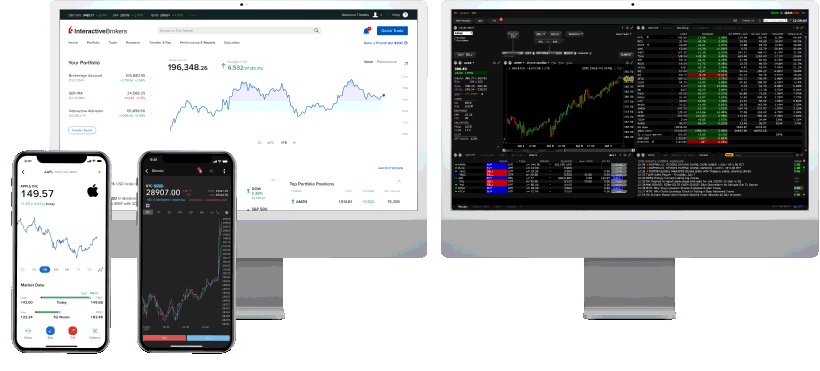

Best for Active Traders and Best Mobile App for Advanced Traders: Interactive Brokers

Fees: 0.12% to 0.18%

Account Minimum: $0

Currencies: 4 Open Account

Why We Chose It

Best for Active Traders

Interactive Brokers is a top choice for active traders who want to trade cryptocurrencies along with other asset classes. Interactive Brokers offers a comprehensive suite of advanced trading tools and services, such as technical analysis, charting, market research, and more. Moreover, Interactive Brokers charges low fees for cryptocurrency trades, ranging from 0.12% to 0.18% per trade.

Best Mobile App for Advanced Traders

Interactive Brokers has also developed a professional mobile trading app that allows sophisticated traders to execute advanced trading strategies in the global crypto asset market. The app has a user-friendly interface and provides access to the same features and functions as the web platform, such as charts, indicators, orders, alerts, and more.

Pros & Cons

Pros

- Provides advanced trading tools and services

- Charges low fees for cryptocurrency trades

- Offers a professional mobile trading app

Cons

- Supports only four cryptocurrencies

- May be too complex for beginners

Overview

Interactive Brokers is one of the oldest and most reputable online brokers age platforms in the industry. Founded in 1977 by Thomas Peterffy, Interactive Brokers provides access to the global financial markets, offering a wide range of asset classes for its customers to trade. From stocks, bonds, and commodities to derivatives, mutual funds, and cryptocurrencies, Interactive Brokers covers almost every corner of the investment universe.

Interactive Brokers launched crypto trading in 2021, allowing its customers to trade four leading cryptocurrencies, namely Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), and Litecoin (LTC). Interactive Brokers stands out for its advanced trading platform, which targets experienced and professional traders. The platform provides market research reports, advanced charting tools, a broad suite of technical indicators, and a sophisticated mobile trading dashboard. Interactive Brokers is the ideal option for advanced traders who want to trade cryptocurrencies with low fees and high performance.

Best for Ease of Trading and Best Mobile App for Beginners: Robinhood

Fees: 0%

Account Minimum: $0

Currencies: 15 Open Account

Why We Chose It

Best for Ease of Trade

Robinhood is a popular trading platform for retail investors in the U.S. who want to trade cryptocurrencies with ease and convenience. Robinhood offers a simple and fun user experience, with a gamified interface and a zero-commission fee model. Robinhood allows anyone to start trading cryptocurrencies with no account minimum and no fees.

Best Mobile App for Beginners

Robinhood has also created a simple and easy-to-use mobile trading app, which has attracted many millennial and Gen-Z traders and investors. The app has a sleek design and provides access to the same features and functions as the web platform, such as charts, news, orders, alerts, and more. The app also has a social aspect, allowing users to share their trades and opinions with other users.

Pros & Cons

Pros

- Offers a simple and fun user experience

- Charges no fees for cryptocurrency trades

- Provides a simple and easy-to-use mobile trading app

Cons

- Lacks advanced trading tools and services

- Has experienced outages and glitches in the past

Overview

Robinhood is one of the most innovative and disruptive trading platforms in the market. Founded in 2013 by Vlad Tenev and Baiju Bhatt, Robinhood aims to democratize finance and make investing accessible to everyone. Robinhood offers a wide range of asset classes for its customers to trade, including stocks, ETFs, options, and cryptocurrencies. Robinhood supports 15 cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), and more.

Robinhood is known for its simple and gamified user experience, which appeals to beginner and casual traders. Robinhood charges no fees for cryptocurrency trades and requires no account minimum to start trading. Robinhood also has a simple and easy-to-use mobile trading app, which has become very popular among millennial and Gen-Z traders and investors. The app has a social element, allowing users to interact with other users and share their trades and opinions. Robinhood is the best option for beginner and casual traders who want to trade cryptocurrencies with ease and convenience.

Pros and Cons of Robinhood Crypto

Pros

- Simple and easy-to-use trading platform: Robinhood has a sleek and intuitive user interface that makes it easy for beginners to start trading crypto. You can buy and sell crypto with just a few taps on your smartphone or clicks on your computer.

- Zero trading fees or commissions: Robinhood does not charge any fees or commissions for trading crypto, which means you can save money and maximize your profits. You can also trade as much as you want without worrying about any limits or minimums.

- Offers cryptocurrency trading and crypto ETFs: Robinhood supports trading of 15 cryptocurrencies, including Bitcoin, Ethereum, Dogecoin, and more. You can also invest in crypto ETFs, which are funds that track the performance of a basket of crypto assets.

Cons

- Limited number of supported cryptocurrencies: Robinhood only supports 15 cryptocurrencies, which is a small fraction of the thousands of crypto assets available in the market. If you want to diversify your portfolio or trade more niche or emerging coins, you will need to use another platform.

- Not available in all states: Robinhood crypto trading is not available in every state in the U.S. Currently, it is only available in 46 states and Washington D.C. You can check the availability of Robinhood crypto trading in your state here.

Overview of Robinhood Crypto

Robinhood was founded by Vlad Tenev and Baiju Bhatt in 2013 to lower the barriers to entry for investors in the United States by offering a very user-friendly trading experience combined with a zero-commission fee model and no deposit minimums.

The appealing nature of no trading fees and no account minimums helped Robinhood rise quickly through the ranks in the competitive online brokerage market as an increasing number of younger investors opted for the trading app over traditional online brokerage accounts.

Robinhood rolled out crypto trading in 2019, initially only in five states, with seven cryptocurrencies, including Bitcoin and Ethereum. Additional crypto assets were added in the years to follow, enabling Robinhood users across the U.S. to now trade 15 digital currencies and tokens.

In 2023, Robinhood launched crypto trading support in the European Union, enabling its European customers to use the beginner-friendly trading app to invest in crypto assets.

Fidelity Review: A Leader in Crypto ETFs

Fidelity is one of the largest and most reputable financial services companies in the world, offering a wide range of investment products and services, including a popular online brokerage platform. In this review, we will focus on its crypto and crypto ETF trading features and evaluate its pros and cons.

Fees: 1%

Account Minimum: $1

Currencies: 2

Pros and Cons of Fidelity Crypto

Pros

- Provides a broad selection of crypto ETFs: Fidelity offers a variety of crypto ETFs, from spot Bitcoin ETFs to Metaverse ETFs and more. Crypto ETFs are funds that track the performance of a basket of crypto assets, allowing investors to gain exposure to the crypto market without having to buy and store individual coins.

- Offers commission-free Fidelity crypto ETFs: Fidelity does not charge any commissions for trading its own crypto ETFs, which means you can save money and invest more. You can also trade other crypto ETFs from other providers, but you may have to pay commissions depending on the ETF.

- Provides educational material: Fidelity provides a lot of educational resources for its customers, including articles, videos, podcasts, webinars, and more. You can learn more about crypto, crypto ETFs, and other investment topics on its website or app.

Cons

- Comparatively high trading fees: Fidelity charges a 1% fee for trading crypto on its platform, which is higher than some of its competitors. This fee is deducted from the amount you trade, which means you will receive less crypto than you paid for. You may also have to pay variable market spreads, which are the differences between the bid and ask prices of the crypto you trade.

- Only supports two cryptocurrencies for spot trading: Fidelity only supports trading of Bitcoin and Ethereum on its platform, which is very limited compared to other platforms that support dozens or hundreds of cryptocurrencies. If you want to trade other coins, you will need to use another platform or buy crypto ETFs that include them.

Overview of Fidelity Crypto

Fidelity was founded in 1943 and headquartered in Boston, Fidelity is one of the largest financial services companies in the world and offers one of the most popular online brokerage platforms in the U.S. The online brokerage platform offers a wide range of asset classes and investment products, enabling its customers to manage most, if not all, of their investment needs on one platform.

Fidelity is also one of the most crypto-friendly companies on Wall Street, having started mining Bitcoin back in 2014 and launching an institutional crypto custody and trading platform called Fidelity Digital Assets in 2018. The full-service broker also provides its customers with the option to add crypto investments to their 401(k) via its Digital Assets Account (DDA).

Fidelity stands out among other brokerage platforms that support crypto trading by offering a wide selection of crypto ETFs, from recently launched spot Bitcoin ETFs to a Metaverse ETF and more. For investors primarily interested in digital asset ETFs, Fidelity is the best option.

For more information, read our full Fidelity Review.

eToro Review: A Social Investing Platform for Crypto

eToro is a multi-asset brokerage and social investing platform that enables you to trade a variety of cryptocurrencies and copy other traders’ trades automatically using the platform’s social trading feature. In this review, we will focus on its crypto trading features and evaluate its pros and cons.

Fees: 1% + variable spread

Account Minimum: $10 (for U.S. residents)

Currencies: 80+

Pros and Cons of eToro Crypto

Pros

- Social trading feature enables users to automatically replicate trades of successful traders: eToro has a unique feature called CopyTrader, which allows you to follow and copy the trades of other users on the platform. You can choose from thousands of traders based on their performance, risk level, portfolio, and more. You can also interact with them and learn from their strategies and insights.

- Offers ready-made Smart Portfolios, making it easier to invest in a basket of crypto assets: eToro also offers Smart Portfolios, which are professionally managed portfolios of crypto assets that are designed to meet different investment goals and risk profiles. You can invest in these portfolios with a single click and enjoy the benefits of diversification and rebalancing.

Cons

- Relatively high commission plus variable market spreads add to trading fees: eToro charges a 1% commission for trading crypto on its platform, which is similar to Fidelity but higher than some other platforms. In addition, you also have to pay variable market spreads, which are the differences between the bid and ask prices of the crypto you trade. These spreads can vary depending on the market conditions and the liquidity of the crypto asset.

- Account minimum and withdrawal fees may deter some users: eToro requires a minimum deposit of $10 for U.S. residents and $200 for non-U.S. residents to start trading on its platform, which may be too high for some users who want to start small. eToro also charges a $5 withdrawal fee, which may discourage some users from withdrawing their funds.

Overview of eToro Crypto

eToro was founded in 2007 and is headquartered in Cyprus, with offices in Israel, the UK, the U.S., and Australia. eToro is a multi-asset brokerage and social investing platform that enables you to trade a variety of cryptocurrencies and other assets, such as stocks, ETFs, commodities, and currencies.

eToro is best known for its social trading feature, which allows you to follow and copy the trades of other users on the platform. You can also create your own portfolio and share it with others, or invest in ready-made Smart Portfolios that are professionally managed by eToro.

eToro supports trading of over 80 cryptocurrencies, including Bitcoin, Ethereum, Cardano, Binance Coin, and more. You can also trade crypto CFDs, which are contracts that track the price movements of crypto assets without owning them. However, CFDs are not available for U.S.

The Bottom Line

The best crypto broker for you depends on your goals and experience level as an investor. Whether you are new to crypto or a seasoned trader, you can find a broker that meets your needs.

For beginners, Robinhood is a great option as it has no fees or minimums and a simple interface. If you want to learn from other traders, you can use eToro’s CopyTrader feature to follow their moves.

For more advanced traders, Interactive Brokers offers a range of tools and indicators for technical analysis and low trading fees. If you prefer a social trading platform, you can also choose eToro and interact with other crypto enthusiasts.

For investors who want to buy crypto ETFs, Fidelity is the best choice as it has a variety of Bitcoin ETFs available.

Compare the Best Online Brokers for Trading Crypto

Table

| Company | Fees | Account Minimum | Currencies | New Spot Bitcoin ETFs |

|---|---|---|---|---|

| Fidelity Investments | 1% | $1 | 2 | Yes |

| Interactive Brokers | 0.12% to 0.18% | $0 | 4 | Yes |

| eToro | 1% + variable spread | $10 | 80+ | Yes |

| Robinhood | 0% | $0 | 15 | Yes |

What Is a Crypto Broker?

A crypto broker is an online platform that lets you buy and sell cryptocurrencies. Some popular examples are Robinhood and eToro.

Unlike crypto exchanges, which are often unregulated, crypto brokers are usually regulated financial services companies that ensure the safety and legality of your transactions.

Also, crypto brokers are generally easier to use than crypto exchanges, which can be confusing for beginners.

How to Get Into Crypto Trading

You can start trading crypto with an online brokers in a few easy steps. Here they are:

Choose a broker: Pick an online brokers that suits your preferences and needs as an investor. Set up an account: Open an account with the broker and fund it. You will usually need to deposit fiat currency, such as dollars. Buy crypto: Select the cryptocurrencies you want to invest in after doing your research and assessing your risk tolerance.

Securely store your crypto investments: When you buy crypto with a broker, you can either keep it with them or transfer it to your own crypto wallet. Choose the option that you are more comfortable with after learning about the advantages and disadvantages of both.

Pros & Cons of Crypto Brokers

Here are some of the benefits and drawbacks of trading crypto with an online brokers.

Pros A familiar look and feel: If you are used to trading stocks or other securities online, you will find it easy to trade crypto with a broker. Regulatory compliance: Online crypto brokers are regulated by authorities, which means your investments are compliant with the rules and regulations. Customer support: Online crypto brokers usually have good customer support, unlike crypto exchanges, which often lack it.

Cons Limited control of funds: When you store your crypto with a broker, you usually can’t use it for other purposes, such as online shopping or decentralized finance. Limited cryptocurrency support: Most online brokers only offer a few cryptocurrencies to trade, which limits your options to diversify your crypto portfolio.

How to Trade Crypto Without a Broker

Crypto brokers are a convenient and easy way to trade cryptocurrencies, but they may not suit everyone’s needs. If you prefer to have more control and flexibility over your crypto trading, you can also use centralized or decentralized crypto exchanges.

- Centralized crypto exchanges: These are platforms that allow you to buy and sell cryptocurrencies using fiat or other digital currencies. They also offer features such as staking and lending, which can help you earn passive income from your crypto holdings. However, they require you to trust them with your funds and personal information, and they may be subject to hacking or regulatory issues.

- Decentralized exchanges (DEXs): These are platforms that enable you to trade cryptocurrencies directly with other users, without intermediaries or custodians. They support a wider range of crypto assets and provide more privacy and security. However, they may have lower liquidity and higher fees, and they require you to use a Web3 wallet, such as MetaMask or Trust Wallet.

The Best Way to Store Your Crypto

As a crypto trader or investor, you need to decide how to store your crypto assets securely and conveniently. You can either keep them on an online platform, such as a broker or an exchange, or in a personal crypto wallet.

- Online platforms: These are the easiest and most accessible way to store your crypto, as you can access them from any device and trade anytime. However, they also expose you to the risk of losing your funds if the platform gets hacked, goes offline, or freezes your account. You also do not have full ownership of your crypto, as you rely on the platform to manage your private keys.

- Crypto wallets: These are software or hardware devices that allow you to store your crypto assets offline, and access them using your private keys. They give you more control and security over your funds, as you are the only one who can access them. However, they also require you to be more responsible and careful, as you may lose your funds if you lose your device or forget your password.

There are two types of crypto wallets: software and hardware.

- Software wallets: These are apps that you can install on your smartphone or computer, and use to send and receive crypto transactions. They are convenient and user-friendly, but they may be vulnerable to malware or phishing attacks. Some examples of software wallets are Exodus, Atomic, and Coinomi.

- Hardware wallets: These are physical devices that store your private keys offline, and connect to your computer or phone via USB or Bluetooth when you want to make a transaction. They are the most secure and reliable way to store your crypto, but they may be more expensive and less convenient. Some examples of hardware wallets are Ledger, Trezor, and KeepKey.

The best crypto storage solution for you depends on your personal preferences and level of technical expertise, but generally speaking, hardware wallets are the safest option for most crypto traders and investors.

Frequently Asked Questions

What is Crypto Trading?

Crypto trading is the activity of buying and selling cryptocurrencies in order to generate regular profits. Unlike crypto investing, which involves holding crypto assets for the long term, crypto trading focuses on short-term opportunities and market fluctuations. Crypto traders use technical analysis tools and indicators to identify the best entry and exit points for their trades.

Crypto trading can be done on different platforms and markets, such as:

- Crypto exchanges: These are platforms that allow you to trade cryptocurrencies using fiat or other digital currencies. They offer different types of orders, such as market, limit, and stop orders, and different types of trading pairs, such as crypto-to-crypto, crypto-to-fiat, and crypto-to-stablecoin.

- Crypto brokers: These are platforms that allow you to trade cryptocurrencies using contracts for difference (CFDs) or other derivatives. They enable you to trade crypto without owning the underlying asset, and to use leverage to amplify your profits or losses.

- Crypto derivatives markets: These are platforms that allow you to trade crypto futures, options, swaps, and other contracts that derive their value from the price of a crypto asset. They enable you to hedge your risk, speculate on price movements, and access more liquidity and leverage.

Should You Use a Broker for Crypto?

The answer to this question depends on your trading goals, preferences, and experience. Using a broker for crypto can have some advantages, such as:

- Ease of use: Brokers are usually more user-friendly and intuitive than crypto exchanges, and they may offer more customer support and education resources.

- Familiarity: If you already have an account with a broker that supports crypto trading, you can use the same platform and interface that you are used to, and avoid the hassle of creating a new account and verifying your identity on a crypto exchange.

- Regulation: Brokers are regulated financial entities that have to comply with certain rules and standards, such as anti-money laundering (AML) and know your customer (KYC) policies. This can provide you with more security and protection, as well as more legal recourse in case of disputes or issues.

However, using a broker for crypto can also have some drawbacks, such as:

- Cost: Brokers may charge higher fees than crypto exchanges, such as spreads, commissions, overnight fees, and withdrawal fees. They may also offer less favorable exchange rates and liquidity than crypto exchanges.

- Limitations: Brokers may not support all the cryptocurrencies and trading pairs that you want to trade, and they may impose limits on your trading amount, leverage, and margin. They may also restrict your access to certain features and markets, such as staking, lending, and derivatives.

- Ownership: When you trade crypto with a broker, you do not actually own the crypto asset that you are trading, but only a contract that represents its value. This means that you do not have the right to claim or use the crypto asset, such as transferring it to another wallet, participating in network governance, or receiving airdrops or forks.

Is Crypto Trading Profitable?

Crypto trading can be profitable if you have the right skills, knowledge, and strategies. The crypto market is highly volatile and dynamic, which can create many opportunities for traders to profit from price movements and trends. Crypto traders can also use various tools and techniques, such as technical analysis, indicators, trading bots, and leverage, to enhance their performance and profitability.

However, crypto trading can also be very risky and challenging, especially for beginners and inexperienced traders. The crypto market is unpredictable and influenced by many factors, such as news, events, sentiment, and regulations, which can cause sudden and drastic price changes. Crypto traders can also face many challenges and pitfalls, such as hacking, scams, fraud, human error, and emotional stress.

Therefore, crypto trading is not a guaranteed or easy way to make money, but rather a complex and demanding activity that requires a lot of research, learning, practice, and discipline. Crypto traders should always be aware of the risks and rewards involved, and never invest more than they can afford to lose.

Spot Trading vs. Crypto Derivatives: What’s the Difference?

When you trade cryptocurrencies, you have two main options: spot trading or crypto derivatives. Spot trading means that you buy or sell the actual coins and get them delivered to your wallet instantly. Crypto derivatives, on the other hand, are contracts that let you bet on the future price of the coins without having to own them. One of the most popular types of crypto derivatives is perpetual swaps, which are similar to futures contracts but have no expiry date.

1 thought on “The Best Online Brokers for Crypto Trading in February 2024”