We delve into the pervasive influence of Cash as Money Laundering Kingpin, exposing its dominance despite growing concerns over digital currencies. Highlighting five shocking revelations, the discussion sheds light on the challenges faced by law enforcement and regulatory bodies. Despite the allure of cash’s anonymity and widespread acceptance, its role in illicit finance poses significant obstacles to combating financial crimes. With a focus on understanding and mitigating these risks, the slug emphasizes the need for proactive measures to address the evolving landscape of illicit finance.

In the realm of illicit finance, the U.S. Treasury Department’s 2024 National Risks Assessments report delivers a sobering revelation: traditional cash remains the reigning monarch of money laundering activities, despite the escalating concerns surrounding cryptocurrencies. This assertion emerges against a backdrop of heightened scrutiny over the role of digital assets in financing illegal operations, including those perpetrated by terrorist organizations.

Treasury Targets Crypto in Financial Crimes

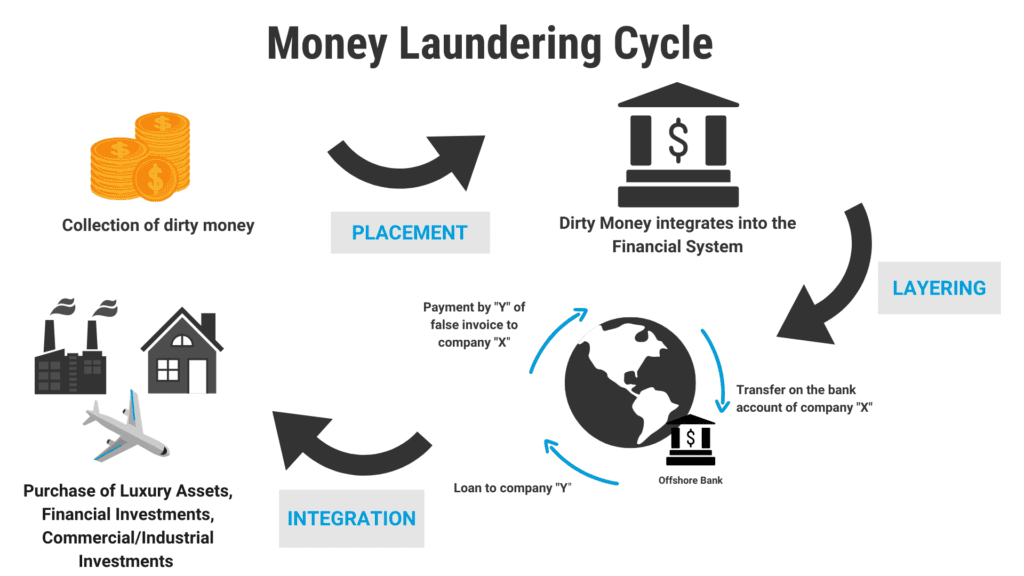

The Treasury’s findings expose an enduring reliance on fiat currencies for laundering illicit funds, with banks and money transmitters serving as preferred conduits for such nefarious activities. This enduring preference for conventional methods underscores the formidable challenges faced by law enforcement and regulatory bodies in combatting illicit financial flows. Even in an era of sophisticated digital platforms, the allure of cash—boasting anonymity and universal acceptance—continues to exert a powerful sway over illicit actors.

The report further identifies the primary catalysts driving money laundering, singling out fraud—particularly through investment schemes and healthcare fraud—as the principal instigator. The proliferation of novel fraud modalities, leveraging technologies such as telemedicine and virtual asset investment scams, emerges as a burgeoning trend, signaling a paradigm shift in how malevolent actors exploit technological advancements for monetary gain.

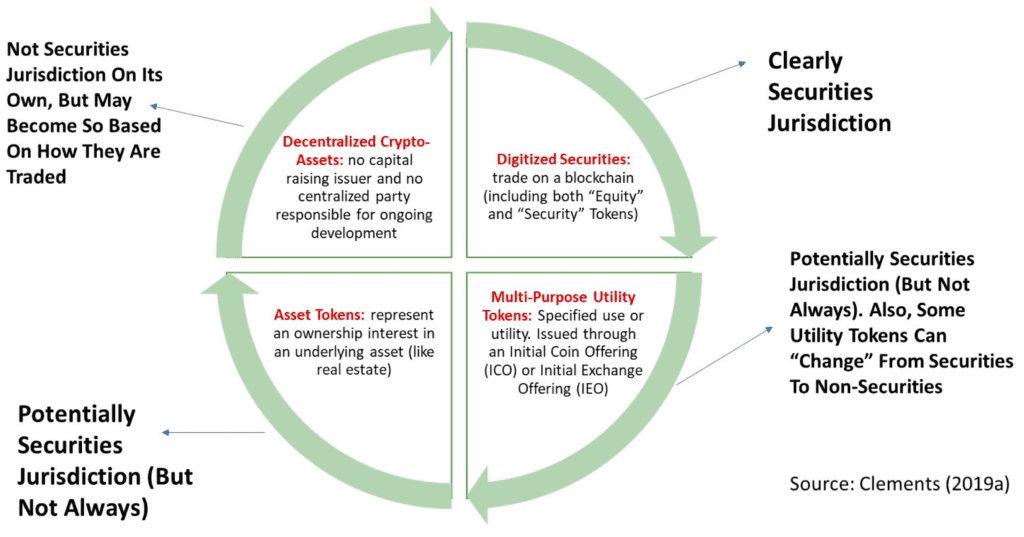

While cash reigns supreme in the realm of money laundering, the Treasury Department does not overlook the mounting threat posed by digital assets. The 2024 National Terrorist Financing Risk Assessment points to an uptick in the utilization of virtual assets by groups like ISIS and Hamas for financing endeavors. This paradigm shift has captured the attention of lawmakers, prompting deliberations on how best to regulate the utilization of cryptocurrencies in funding illegal activities, without compromising privacy rights or undermining the inherent transparency of blockchain technology.

A pivotal juncture in this discourse was the House Financial Services Committee’s November hearing, which delved into the ramifications of cryptocurrency in facilitating illicit finance. Testimonies from industry luminaries, including Jonathan Levin of Chainalysis and former federal prosecutor Jane Khodarkovsky, underscored the imperative of adopting a balanced approach that safeguards national security interests while respecting the privacy concerns of law-abiding users.

Looking Ahead: Strategies for Combatting Illicit Finance

The Treasury Department’s steadfast commitment to addressing these pressing challenges is palpable in its forthcoming annual strategy for combating illicit finance. Anticipated to encompass comprehensive recommendations for tackling the issues delineated in the 2024 assessments, this strategy reflects a proactive stance towards confronting evolving financial threats.

Furthermore, the bipartisan fervor evinced by Congress, epitomized by the missive to President Joe Biden and Treasury Secretary Janet Yellen, underscores the political resolve to comprehend and mitigate the perils associated with entities like Hamas financing their operations through cryptocurrencies. This concerted endeavor symbolizes a pivotal stride towards adapting regulatory frameworks to the exigencies of contemporary finance, striking a delicate balance between bolstering security and preserving innovation and privacy.

While the contours of illicit finance evolve in tandem with technological progress, the latest assessments from the U.S. Treasury Department serve as a stark reminder: traditional avenues for money laundering remain prevalent. For policymakers and regulators, the task at hand entails navigating the nuanced threats posed by digital assets, charting a course that safeguards the integrity of the financial system while fostering innovation and inclusivity.

What are some examples of investment schemes used for money laundering?

Some common examples of investment schemes used for money laundering include:

- Real Estate Laundering: Criminals invest illicit funds into the property market, disguising the true origin of their wealth.

- Smurfing or Structuring: This technique involves breaking down large cash sums into smaller portions and depositing them to circumvent financial regulations that require banks to report large transactions.

- Cash-Intensive Businesses: Money launderers may overstate the income of their cash-intensive businesses to justify the influx of illegal proceeds by exaggerating revenue and inflating expenses.

- Reselling Assets: Criminals may purchase big-ticket items with cash and then quickly resell those items to have money they are able to actually use in their bank.

- Trade-Based Money Laundering: Criminals can use businesses to deposit and process their illegal cash, making it difficult for authorities to trace the original source.

These examples illustrate the diverse and sophisticated methods employed by money launderers to integrate illicit funds into the legitimate financial system.

1 thought on “Unveiling the Dark Dominance of Cash as Money Laundering Kingpin in 2024”