Books can hold decades of earned knowledge in the span of a few hundred pages. When it comes to understanding finances, fewer decisions are easier, cheaper, or more impactful than the move to educate yourself with a great investing book. Money touches everything we do, so learning how to properly invest early in life can make a huge difference in your ultimate success.

It’s important to learn investment terminology. You’ll want to understand the difference between a stock and a bond, how cryptocurrency works, how inflation affects investments, the role of risk tolerance, and how tax efficiency can increase a portfolio’s return. It’s equally important to understand what money does and doesn’t do for a person seeking to grow wealth for future life events. That includes how we interact with money, how family experiences can shape our investment outlook, and how significant debt can be a drag on our ability to achieve life goals.

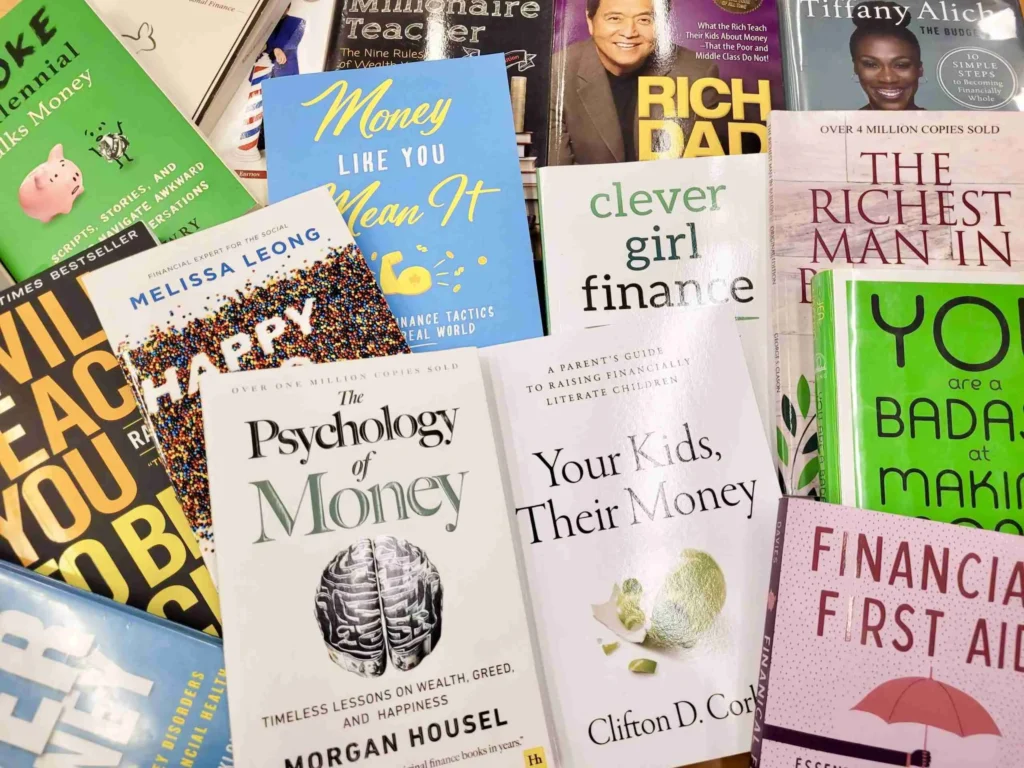

To assist you in this endeavor, here’s a list of 11 great books that address multiple aspects of the investing process. The authors range from leading financial gurus of their time to female, minority, and next-generation authors who shape new perspectives.

“The Intelligent Investor”

“The Intelligent Investor” by Benjamin Graham is a widely acclaimed book on value investing. First published in 1949, it provides strategies on how to successfully use value investing in the stock market. The book teaches readers to focus on long-term value over short-term gains and encourages them to analyze a company’s financial reports and operations while ignoring the market’s whims.

Graham’s favorite allegory was that of Mr. Market, an imaginary person who offers to buy or sell shares at varying prices. The book is a practical guide that teaches readers to apply Graham’s principles, including valuation and patience, to craft a reliable portfolio that requires minimum maintenance and offers maximum odds of a steady return.

“Poor Charlie’s Almanack: The Essential Wit and Wisdom of Charles T. Munger”

“Poor Charlie’s Almanack: The Essential Wit and Wisdom of Charles T. Munger” is a collection of speeches and essays by Charles Munger, the long-time business partner of Warren Buffett. The book provides insights into Munger’s philosophy and approach to life, business, and investing. It delves into his inspiring ethical investment philosophy, the importance of paying taxes, and his dedication to philanthropy.

Munger’s speeches cover a wide range of topics, including rationality, decision making, and the traits leading to a happy and productive life. The book offers a glimpse into the life and investment philosophies of one of the world’s most reclusive billionaires, making it a valuable resource for those interested in business and finance.

“The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns”

It is a classic guide that emphasizes the importance of index investing. Bogle, the late founder of The Vanguard Group, advocates for a long-term investment approach and the reduction of internal fees. He promotes the use of index mutual funds and dollar-cost averaging. The book provides valuable insights into sound investment strategies and the benefits of maintaining a long-term perspective, making it a valuable resource for both novice and experienced investors.

A Beginner’s Guide to the Stock Market: Everything You Need to Start Making Money Today

It is a comprehensive guide for novice investors who want to learn how to invest in the stock market. The book covers the basics of investing, including how to open a brokerage account, how to buy your first investment, and how to generate passive income in the stock market.

It also provides insights into trading strategies, such as momentum trading and value investing, and offers insider tricks used by professional traders. The book is a simple road map that anyone can follow, making it an excellent resource for those who want to start investing in the stock market.

Investing QuickStart Guide: The Simplified Beginner’s Guide to Successfully Navigating the Stock Market, Growing Your Wealth & Creating a Secure Financial Future

It is a comprehensive and well-written book designed for new investors. It is presented in plain English and provides valuable insights into the stock market and various investing strategies. The book covers a wide range of topics, including a deeper dive into asset classes, managing tax liabilities, and the pros and cons of new finance technologies.

It is updated and revised to reflect the realities of the current investing environment. Written by a CFP® practitioner with over 30 years of investment experience, this guide is the ultimate beginner’s resource for those who want to make their money work for them. It has been reviewed by The Financial Industry Regulatory Authority (FINRA) and is a valuable learning companion tailored for beginners. The book is a great starting point for those who want to feel confident and comfortable in their investment journey.

Rich Dad Poor Dad

“Rich Dad Poor Dad” by Robert T. Kiyosaki is a personal finance book that challenges traditional beliefs about money and emphasizes the importance of financial education. The book is written from Kiyosaki’s perspective, detailing the contrasting financial philosophies of his two influential fathers – his real father (poor dad) and the father of his best friend (rich dad).

It explores how the rich make money work for them, the history of taxes and the power of corporations, and the significance of financial literacy. Kiyosaki’s book has become a global bestseller, offering valuable insights into wealth creation and financial independence.

How to Money: Your Ultimate Visual Guide to the Basics of Finance

“How to Money: Your Ultimate Visual Guide to the Basics of Finance” by Jean Chatzky, Kathryn Tuggle, and the HerMoney Team is a self-help guide that provides a comprehensive overview of fundamental financial concepts. The book is divided into five sections: Earn It, Manage It, Use It, Get Schooled, and Look to the Future.

It is designed to educate teenagers and college-aged individuals about money and finance, covering topics such as earning money, managing it, and making informed financial decisions. The book is written in a visually engaging style and includes illustrations to make the content more accessible. It is a valuable resource for those entering the workforce or seeking to improve their understanding of basic financial principles.

Get Good With Money: 10 Simple Steps to Becoming Financially Whole

“Get Good With Money: 10 Simple Steps to Becoming Financially Whole” by Tiffany Aliche is a practical guide that teaches readers how to take control of their finances. The book covers ten fundamental steps to achieve financial wholeness, including building a budget, saving, paying off debt, improving credit scores, increasing income, investing, and planning for retirement.

The book is written in a simple and engaging style, with helpful checklists, worksheets, and resources. It is a valuable resource for anyone who wants to improve their financial literacy and achieve financial security.

Broke Millennial Takes on Investing: A Beginner’s Guide to Leveling Up Your Money

“Broke Millennial Takes on Investing: A Beginner’s Guide to Leveling Up Your Money” by Erin Lowry is a comprehensive guide for novice investors who want to learn how to invest in the stock market. The book covers the basics of investing, including how to open a brokerage account, how to buy your first investment, and how to generate passive income in the stock market.

It also provides insights into trading strategies, such as momentum trading and value investing, and offers insider tricks used by professional traders. The book is written in a simple and engaging style, with helpful checklists, worksheets, and resources. It is a valuable resource for anyone who wants to start investing in the stock market, especially millennials who are new to investing.

The Total Money Makeover: A Proven Plan for Financial Fitness

“The Total Money Makeover: A Proven Plan for Financial Fitness” by Dave Ramsey is a personal finance book that provides a comprehensive plan for achieving financial stability. The book teaches readers how to get out of debt, budget, and plan for upcoming financial events like retirement.

It also shares stories of individuals and couples who have successfully achieved financial stability using the book’s principles. The book teaches the seven “baby steps” to follow in order to achieve financial stability, including saving a $1,000 beginner emergency fund, getting out of debt using the debt-snowball method, and investing. The book is a valuable resource for anyone who wants to achieve financial stability and independence.

The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness

“The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness” by Morgan Housel is a personal finance book that explores the psychology behind money and wealth. The book provides insights into how people think about money and how their emotions and behaviors affect their financial decisions.

It covers a wide range of topics, including the role of luck and risk in investing, the importance of time in building wealth, and the paradox of wealth. The book is written in an engaging and accessible style, making it a valuable resource for anyone interested in personal finance and investing.

Conclusion for Best Investing Books for Beginners:

The selection of financial literacy books provides a well-rounded knowledge base, catering to both technical and emotional aspects of investing. These resources are valuable for inexperienced investors, offering the confidence and comfort needed to craft a budget, reduce debt, and gain the knowledge required to either delve deeper into personal investing or engage in meaningful conversations with financial advisors.

The books cover a wide range of topics, including the basics of finance, investing, and creating a secure financial future. They are written in an engaging and accessible style, making them suitable for individuals at various stages of their financial journey. The insights and strategies offered in these books can empower readers to make informed and effective decisions, ultimately contributing to their long-term financial well-being.

1 thought on “11 of the Best Investing Books for Beginners”