Are you on the hunt for bargains in the stock market? If you’ve got $5,000 ready to invest in established growth cheap stocks to buy now, consider these three cheap stocks backed by promising businesses: Alibaba Group (NYSE: BABA), United Parcel Service (NYSE: UPS), and AstraZeneca (NASDAQ: AZN).

1. Alibaba Group

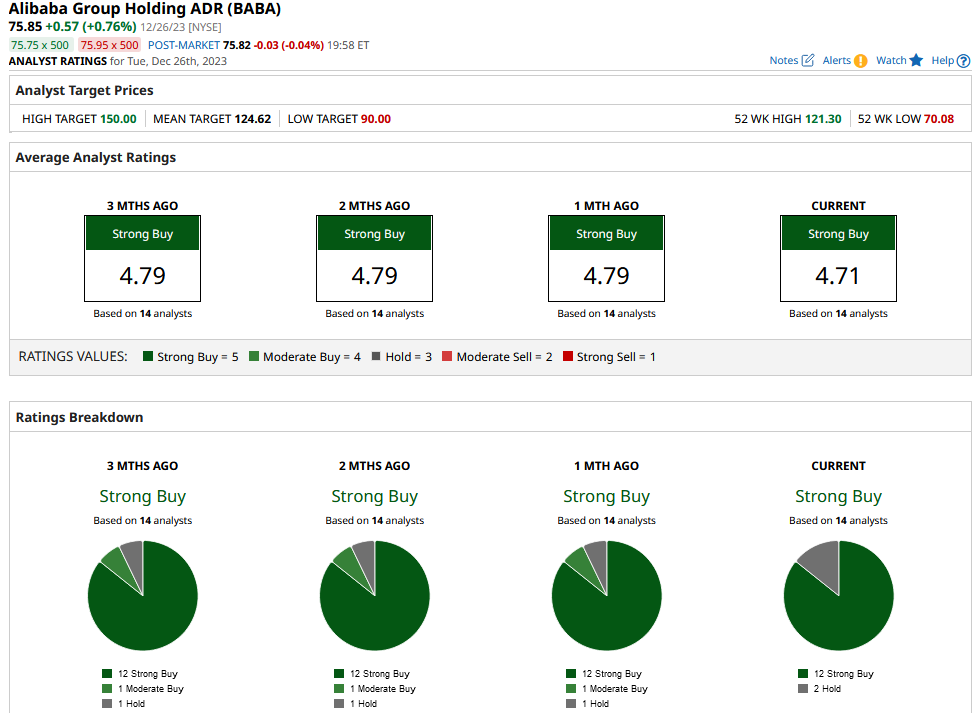

Chinese stocks have been undervalued due to ongoing tensions between China and the U.S., making China an attractive investment market. Despite economic growth concerns, Alibaba remains discounted, trading at less than 8 times its expected future profits. With diversified operations including online shopping platforms and a growing cloud infrastructure business, Alibaba presents a compelling investment opportunity.

What are the risks associated with investing in alibaba group?

Some of the key risks associated with investing in Alibaba Group include:

- Regulatory Environment in China: The regulatory environment in China can change rapidly and significantly impact the company. Changes in regulations or policies related to e-commerce or technology could affect Alibaba’s business1.

- Economic and Political Instability: Economic and political instability in China could affect the overall business environment and the demand for Alibaba’s products. For example, the current recession in China has impacted the demand for online shopping and e-commerce.

- Currency Fluctuations: Currency fluctuations can pose a risk to Alibaba’s business, especially as it operates in multiple countries with different currencies1.

- Debt and Financing: The company’s debt and financing structure can also be a risk factor to consider. While it has a strong cash position, the balance between its liabilities and cash reserves should be carefully evaluated.

- Business Performance: Alibaba’s e-commerce revenue has been contracting, and the company faces the challenge of turning around its Chinese e-commerce business, especially amid increasing competition.

In conclusion, while Alibaba Group presents an attractive investment opportunity, it is important for investors to carefully evaluate and consider these risks before making an investment decision.

What is the current stock price of alibaba group?

The current stock price of Alibaba Group Holding Limited (BABA) is approximately $70.78. This price is subject to change as it is based on the latest available data.

2. United Parcel Service

United Parcel Service (UPS) offers another attractive investment option, trading at less than 17 times its future expected profits. Despite recent challenges, UPS plays a crucial role in the logistics industry and the U.S. economy’s growth trajectory. As geopolitical conditions improve and e-commerce expands, UPS is positioned for stronger demand, making it a solid long-term investment choice.

What are the risks associated with investing in United Parcel Service (UPS)?

Some of the key risks associated with investing in United Parcel Service (UPS) include:

- Economic and Political Environment: UPS is exposed to risks related to changes in economic and political conditions, which could impact its business.

- Natural and Human Disruptions: UPS is exposed to risks related to catastrophes, floods, storms, terror, earthquakes, and the coronavirus pandemic/COVID-19.

- International Operations: As a global company, UPS is exposed to risks related to the global nature of its business, including currency fluctuations and geopolitical risks.

- Corporate Activity and Growth: Risks related to restructuring, mergers and acquisitions, joint ventures, and execution of corporate strategy can impact UPS’s business.

- Capital Markets: Risks related to exchange rates and trade, as well as cryptocurrency, can impact UPS’s business.

- Competition: UPS faces competition from other logistics and delivery companies, which could impact its market share and profitability.

- Debt and Financing: UPS’s debt and financing structure can also be a risk factor to consider. While the company has a strong balance sheet, its debt levels could impact its future options and returns.

In conclusion, while UPS presents an attractive investment opportunity, it is important for investors to carefully evaluate and consider these risks before making an investment decision.

What is the current stock price of united parcel service?

The current stock price of United Parcel Service (UPS) is approximately $146.71. This price is based on the latest available data and is subject to change.

3. AstraZeneca

AstraZeneca, a leading healthcare company, presents an undervalued stock opportunity, trading at less than 16 times its estimated future profits. With a diverse portfolio spanning multiple therapeutic areas and a robust pipeline of projects, AstraZeneca offers significant growth potential. Despite its blockbuster drugs and impressive revenue figures, AstraZeneca remains overlooked, making it an appealing option for long-term investors.

Considering a $1,000 investment in Alibaba Group? Before you proceed, it’s worth noting that the Motley Fool Stock Advisor analyst team has identified other top stocks for investors to buy now. With Stock Advisor’s proven track record of success, including regular updates and expert guidance, explore all options before making your investment decision.

What are the risks associated with investing in AstraZeneca?

Some of the key risks associated with investing in AstraZeneca include:

- Regulatory Risks: AstraZeneca is subject to regulatory risks, including delays in regulatory approvals, changes in regulations, and patent litigation.

- Economic and Political Risks: Economic and political instability in the countries where AstraZeneca operates could impact its business.

- Supply Chain Risks: AstraZeneca is exposed to supply chain risks, including disruptions in the supply of raw materials, manufacturing issues, and distribution challenges.

- Competition: AstraZeneca faces competition from other pharmaceutical companies, which could impact its market share and profitability.

- Clinical Trials Risks: The development of new drugs is a complex and risky process, and AstraZeneca’s success depends on the outcome of its clinical trials.

- Data Management Risks: AstraZeneca is obliged to meet legal, regulatory, and ethical requirements when it collects, shares, and utilizes data, and failure to do so could have an adverse impact on its business.

What is the current stock price of AstraZeneca?

The current stock price of AstraZeneca PLC (AZN) is approximately $63.52. Please note that stock prices are subject to change as they are based on the latest available data.

In conclusion, while AstraZeneca presents an attractive investment opportunity, it is important for investors to carefully evaluate and consider these risks before making an investment decision.

Invest wisely and seize the opportunity to add these cheap stocks to your portfolio for long-term growth potential.

Conclusive statement: cheap stocks to buy now

The quest for cheap stocks to buy now presents investors with a compelling opportunity to capitalize on undervalued assets with significant growth potential. The three highlighted stocks – Alibaba Group, United Parcel Service (UPS), and AstraZeneca – offer promising prospects for long-term investors seeking solid returns on their investments.

Alibaba Group stands out as a discounted option in the Chinese market, trading at a remarkably low valuation compared to its expected future profits. With a diverse business portfolio spanning e-commerce, digital media, and cloud infrastructure, Alibaba presents a strong investment case in an evolving digital landscape.

Similarly, United Parcel Service (UPS) presents an attractive proposition, trading at a modest multiple of its future expected profits. Despite recent challenges, UPS plays a pivotal role in the logistics industry and is poised to benefit from improving geopolitical conditions and the expansion of e-commerce.

AstraZeneca emerges as an overlooked gem in the healthcare sector, offering investors the opportunity to acquire its stock at a modest valuation. With a diverse portfolio of blockbuster drugs and a robust pipeline of projects, AstraZeneca presents significant growth potential for investors willing to take a long-term view.

In navigating the stock market landscape, investors should conduct thorough research and consider factors such as industry trends, company fundamentals, and market conditions. While cheap stocks may present attractive entry points, it’s essential to assess the underlying business prospects and potential risks associated with each investment.

Ultimately, by identifying and investing in cheap stocks with strong fundamentals and growth prospects, investors can position themselves for long-term success and capitalize on opportunities for wealth accumulation in the dynamic world of finance.

1 thought on “Cheap Stocks to Buy Now: A $5,000 Investment Opportunity”