Stay informed with the latest SEC vs Ripple news. Explore comprehensive updates, legal insights, and potential impacts on the crypto landscape. Navigate the regulatory landscape confidently with our up-to-date coverage.

The ongoing legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC) has sparked intense speculation about a potential settlement as a crucial hearing date approaches.

On February 12, a significant examination of remedies briefing is scheduled to take place in the SEC vs. Ripple case, leading to discussions within the crypto community. One prominent theory suggests that a settlement might involve Ripple burning its over 40 billion XRP tokens held in escrow, an action estimated to be worth over $20 billion.

As the hearing date nears, the crypto community is abuzz with speculations regarding the potential settlement terms between Ripple and the SEC. One theory suggests that Ripple may be required to burn its vast holdings of XRP tokens, totaling over 40 billion currently held in escrow, which, at the current market value of $0.51 per XRP, would entail the destruction of over $20 billion worth of tokens.

This speculation has drawn parallels to a previous legal dispute between the SEC and LBRY, where the SEC sought a court order to prevent LBRY from engaging in cryptocurrency offerings until it disposed of all its LBRY Credits (LBC) tokens.

However, some online commentators contest the feasibility of this scenario in the Ripple case, arguing that the initial lawsuit against Ripple imposed a $1.3 billion charge on the payment company, making it seem illogical to incinerate over $20 billion in XRP tokens as part of settlement terms.

Additionally, concerns have been raised by influential figures in the cryptocurrency sphere, such as Cardano founder Charles Hoskinson, who has voiced apprehensions about the potential implications of a settlement between Ripple and the SEC. Hoskinson argues that such a settlement could imply an admission that XRP was a security, potentially empowering the SEC to pursue similar arguments against other Layer 1 cryptocurrency projects.

In the midst of these speculations, it’s important to note that the specifics of the settlement between Ripple and the SEC remain confidential, as evidenced by the recent settlement of Ripple’s $15 million XRP case with GCC Exchange, which was resolved in an amicable manner with no fault admitted.

Furthermore, the SEC’s stronger legal position against Ripple has important consequences for both the company and the broader crypto landscape. While the outcome of the Ripple-SEC legal battle remains uncertain, the intensifying speculations and discussions within the crypto community reflect the significant impact that a potential settlement could have on the cryptocurrency industry.

As the hearing date approaches, the crypto community will be closely monitoring the developments in the SEC vs. Ripple case, as it has the potential to shape the future regulatory landscape for cryptocurrencies.

What is the sec vs. ripple case about?

The SEC vs. Ripple case is a legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC) that began in December 2020. The SEC alleges that Ripple used an unregistered security to raise funds, claiming that Ripple raised more than $1.3 billion in 2013 by selling XRP in an unregistered security offering.

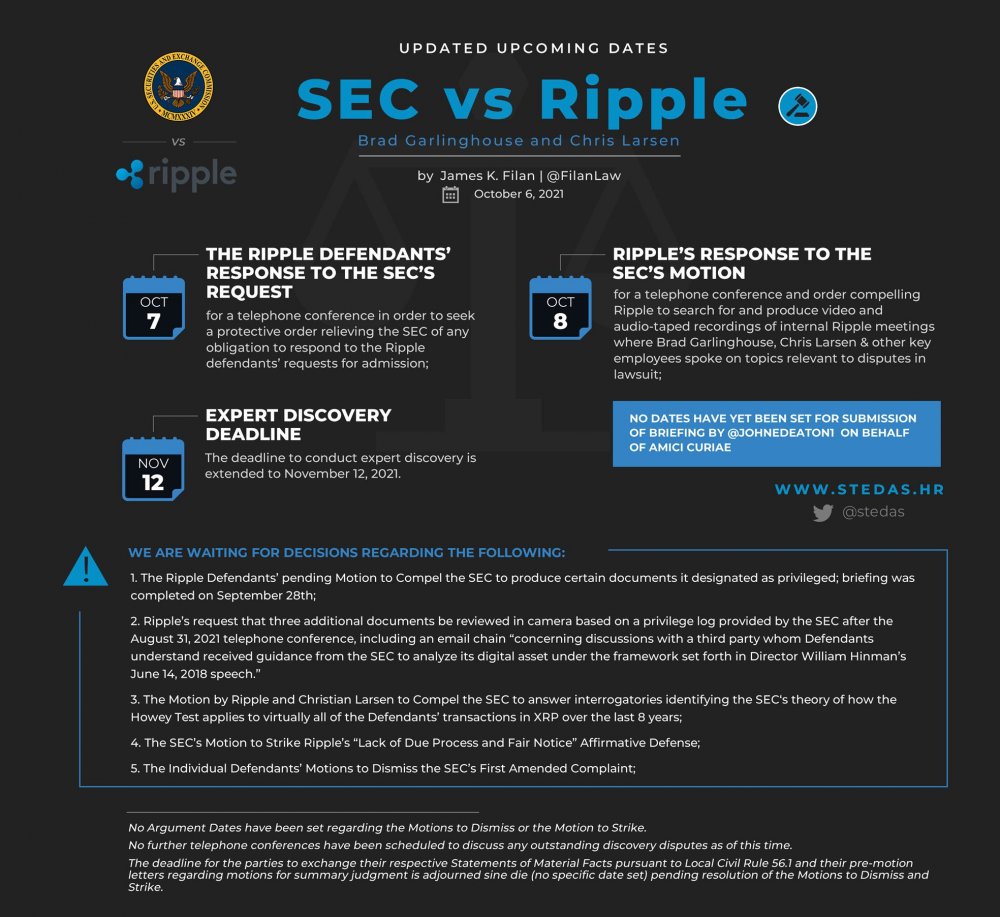

The SEC charged Ripple and two of its executives, Brad Garlinghouse and Christian Larsen, with selling unregulated securities valued at more than $1.3 billion. The crux of the lawsuit involves whether Ripple’s token, XRP, is itself a security under the federal securities laws or if the underlying transaction is a security.

The case is important because it could have far-reaching consequences for Ripple, the SEC, and the broader cryptocurrency industry. The outcome of the case is still uncertain, and Ripple may appeal the judgment or suggest a settlement with the SEC to resolve the outstanding issues.

What is the status of the sec vs. ripple case?

The latest update on the case is that the SEC has dropped charges against Ripple CEO Brad Garlinghouse and Chairman Chris Larsen, but the SEC will continue pursuing its claims against Ripple.

The legal process is expected to continue with more proceedings following the SEC’s partial victory, and Ripple may appeal the judgment or suggest a settlement with the SEC to resolve the outstanding issues.

What is the next court date for the sec vs ripple news case?

The next court date for the SEC vs. Ripple case is February 12, 2024. This is the deadline provided by the court for both parties to complete remedies-related briefing. The SEC must file its brief with respect to remedies by March 13, 2024, whereas Ripple must file its opposition by April 12, 2024.

The legal process is expected to continue with more proceedings following the SEC’s partial victory, and Ripple may appeal the judgment or suggest a settlement with the SEC to resolve the outstanding issues. The trial is scheduled for April 23, 2024.

1 thought on “Empowering Insights: Positive SEC vs Ripple News 2025”